Page 90 - BA2 Integrated Workbook STUDENT 2018

P. 90

Chapter 5

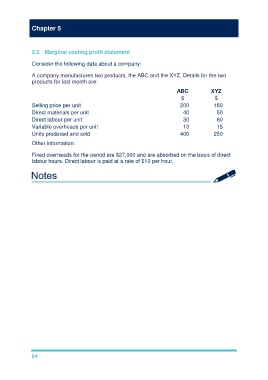

2.2 Marginal costing profit statement

Consider the following data about a company:

A company manufactures two products, the ABC and the XYZ. Details for the two

products for last month are:

ABC XYZ

$ $

Selling price per unit 200 180

Direct materials per unit 40 50

Direct labour per unit 30 60

Variable overheads per unit 10 15

Units produced and sold 400 250

Other information:

Fixed overheads for the period are $27,000 and are absorbed on the basis of direct

labour hours. Direct labour is paid at a rate of $10 per hour.

84