Page 30 - FINAL CFA I SLIDES JUNE 2019 DAY 9

P. 30

Session Unit 9:

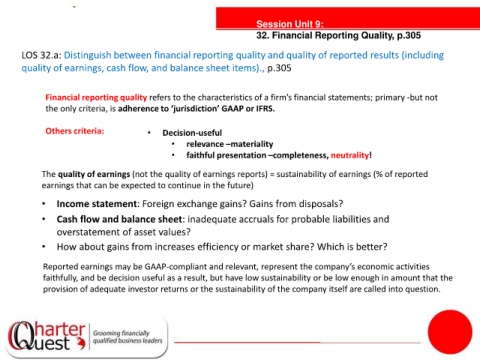

32. Financial Reporting Quality, p.305

LOS 32.a: Distinguish between financial reporting quality and quality of reported results (including

quality of earnings, cash flow, and balance sheet items)., p.305

Financial reporting quality refers to the characteristics of a firm’s financial statements; primary -but not

the only criteria, is adherence to ‘jurisdiction’ GAAP or IFRS.

Others criteria: • Decision-useful

• relevance –materiality

• tanties

faithful presentation –completeness, neutrality!

The quality of earnings (not the quality of earnings reports) = sustainability of earnings (% of reported

earnings that can be expected to continue in the future)

• Income statement: Foreign exchange gains? Gains from disposals?

• Cash flow and balance sheet: inadequate accruals for probable liabilities and

overstatement of asset values?

• How about gains from increases efficiency or market share? Which is better?

Reported earnings may be GAAP-compliant and relevant, represent the company’s economic activities

faithfully, and be decision useful as a result, but have low sustainability or be low enough in amount that the

provision of adequate investor returns or the sustainability of the company itself are called into question.