Page 33 - FINAL CFA I SLIDES JUNE 2019 DAY 9

P. 33

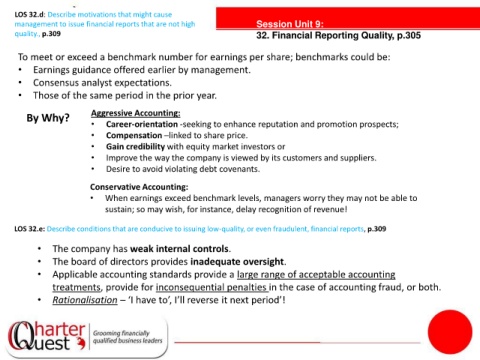

LOS 32.d: Describe motivations that might cause

management to issue financial reports that are not high Session Unit 9:

quality., p.309 32. Financial Reporting Quality, p.305

To meet or exceed a benchmark number for earnings per share; benchmarks could be:

• Earnings guidance offered earlier by management.

• Consensus analyst expectations.

• Those of the same period in the prior year.

Aggressive Accounting:

By Why?

• Career-orientation -seeking to enhance reputation and promotion prospects;

• Compensation –linked to share price.

• Gain credibility with equity market investors or

tanties

• Improve the way the company is viewed by its customers and suppliers.

• Desire to avoid violating debt covenants.

Conservative Accounting:

• When earnings exceed benchmark levels, managers worry they may not be able to

sustain; so may wish, for instance, delay recognition of revenue!

LOS 32.e: Describe conditions that are conducive to issuing low-quality, or even fraudulent, financial reports, p.309

• The company has weak internal controls.

• The board of directors provides inadequate oversight.

• Applicable accounting standards provide a large range of acceptable accounting

treatments, provide for inconsequential penalties in the case of accounting fraud, or both.

• Rationalisation – ‘I have to’, I’ll reverse it next period’!