Page 37 - FINAL CFA I SLIDES JUNE 2019 DAY 9

P. 37

Session Unit 9:

32. Financial Reporting Quality, p.305

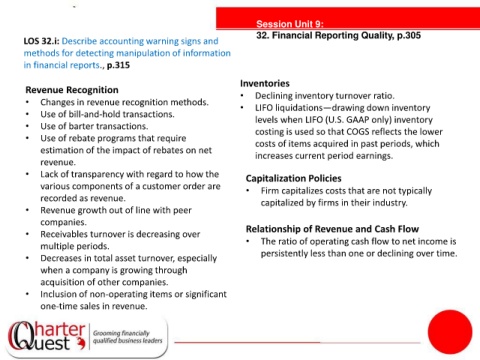

LOS 32.i: Describe accounting warning signs and

methods for detecting manipulation of information

in financial reports., p.315

Inventories

Revenue Recognition •

• Changes in revenue recognition methods. • Declining inventory turnover ratio.

• Use of bill-and-hold transactions. LIFO liquidations—drawing down inventory

• Use of barter transactions. levels when LIFO (U.S. GAAP only) inventory

• Use of rebate programs that require costing is used so that COGS reflects the lower

costs of items acquired in past periods, which

tanties

estimation of the impact of rebates on net increases current period earnings.

revenue.

• Lack of transparency with regard to how the Capitalization Policies

various components of a customer order are • Firm capitalizes costs that are not typically

recorded as revenue. capitalized by firms in their industry.

• Revenue growth out of line with peer

companies.

• Receivables turnover is decreasing over Relationship of Revenue and Cash Flow

multiple periods. • The ratio of operating cash flow to net income is

• Decreases in total asset turnover, especially persistently less than one or declining over time.

when a company is growing through

acquisition of other companies.

• Inclusion of non-operating items or significant

one-time sales in revenue.