Page 18 - PowerPoint Presentation

P. 18

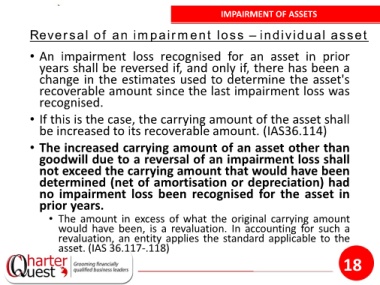

IMPAIRMENT OF ASSETS

Reversal of an impairment loss – individual asset

• An impairment loss recognised for an asset in prior

years shall be reversed if, and only if, there has been a

change in the estimates used to determine the asset's

recoverable amount since the last impairment loss was

recognised.

• If this is the case, the carrying amount of the asset shall

be increased to its recoverable amount. (IAS36.114)

• The increased carrying amount of an asset other than

goodwill due to a reversal of an impairment loss shall

not exceed the carrying amount that would have been

determined (net of amortisation or depreciation) had

no impairment loss been recognised for the asset in

prior years.

• The amount in excess of what the original carrying amount

would have been, is a revaluation. In accounting for such a

revaluation, an entity applies the standard applicable to the

asset. (IAS 36.117-.118)

18