Page 17 - PowerPoint Presentation

P. 17

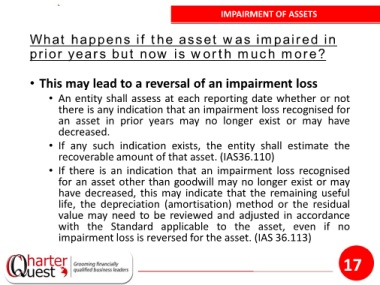

IMPAIRMENT OF ASSETS

What happens if the asset was impaired in

prior years but now is worth much more?

• This may lead to a reversal of an impairment loss

• An entity shall assess at each reporting date whether or not

there is any indication that an impairment loss recognised for

an asset in prior years may no longer exist or may have

decreased.

• If any such indication exists, the entity shall estimate the

recoverable amount of that asset. (IAS36.110)

• If there is an indication that an impairment loss recognised

for an asset other than goodwill may no longer exist or may

have decreased, this may indicate that the remaining useful

life, the depreciation (amortisation) method or the residual

value may need to be reviewed and adjusted in accordance

with the Standard applicable to the asset, even if no

impairment loss is reversed for the asset. (IAS 36.113)

17