Page 188 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 188

Chapter 8

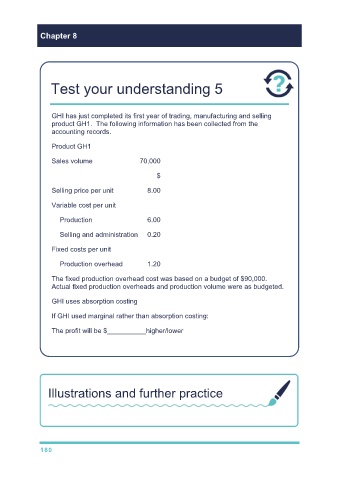

Test your understanding 5

GHI has just completed its first year of trading, manufacturing and selling

product GH1. The following information has been collected from the

accounting records.

Product GH1

Sales volume 70,000

$

Selling price per unit 8.00

Variable cost per unit

Production 6.00

Selling and administration 0.20

Fixed costs per unit

Production overhead 1.20

The fixed production overhead cost was based on a budget of $90,000.

Actual fixed production overheads and production volume were as budgeted.

GHI uses absorption costing

If GHI used marginal rather than absorption costing:

The profit will be $ higher/lower

Illustrations and further practice

Now try TYU question 3 from Chapter 8

180