Page 191 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 191

Absorption and marginal costing

Test your understanding answers

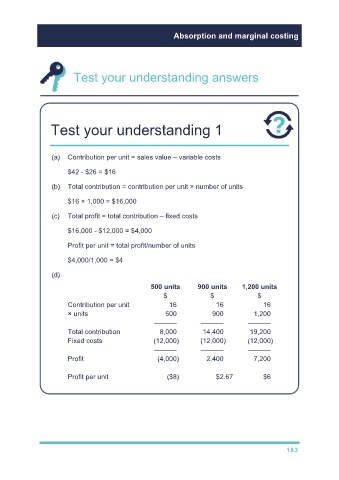

Test your understanding 1

(a) Contribution per unit = sales value – variable costs

$42 - $26 = $16

(b) Total contribution = contribution per unit × number of units

$16 × 1,000 = $16,000

(c) Total profit = total contribution – fixed costs

$16,000 - $12,000 = $4,000

Profit per unit = total profit/number of units

$4,000/1,000 = $4

(d)

500 units 900 units 1,200 units

$ $ $

Contribution per unit 16 16 16

× units 500 900 1,200

–––––– –––––– ––––––

Total contribution 8,000 14,400 19,200

Fixed costs (12,000) (12,000) (12,000)

–––––– –––––– ––––––

Profit (4,000) 2,400 7,200

Profit per unit ($8) $2.67 $6

183