Page 193 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 193

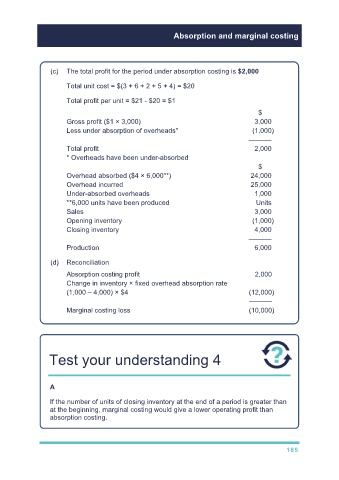

Absorption and marginal costing

(c) The total profit for the period under absorption costing is $2,000

Total unit cost = $(3 + 6 + 2 + 5 + 4) = $20

Total profit per unit = $21 - $20 = $1

$

Gross profit ($1 × 3,000) 3,000

Less under absorption of overheads* (1,000)

––––––

Total profit 2,000

* Overheads have been under-absorbed

$

Overhead absorbed ($4 × 6,000**) 24,000

Overhead incurred 25,000

Under-absorbed overheads 1,000

**6,000 units have been produced Units

Sales 3,000

Opening inventory (1,000)

Closing inventory 4,000

––––––

Production 6,000

(d) Reconciliation

Absorption costing profit 2,000

Change in inventory × fixed overhead absorption rate

(1,000 – 4,000) × $4 (12,000)

––––––

Marginal costing loss (10,000)

Test your understanding 4

A

If the number of units of closing inventory at the end of a period is greater than

at the beginning, marginal costing would give a lower operating profit than

absorption costing.

185