Page 209 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 209

Process costing

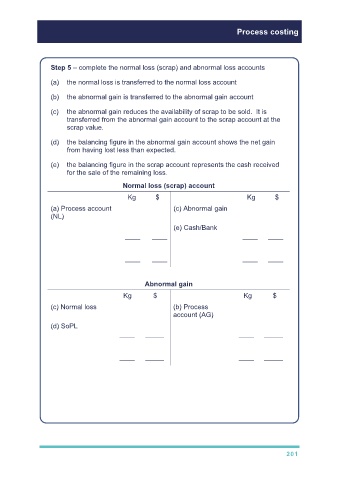

Step 5 – complete the normal loss (scrap) and abnormal loss accounts

(a) the normal loss is transferred to the normal loss account

(b) the abnormal gain is transferred to the abnormal gain account

(c) the abnormal gain reduces the availability of scrap to be sold. It is

transferred from the abnormal gain account to the scrap account at the

scrap value.

(d) the balancing figure in the abnormal gain account shows the net gain

from having lost less than expected.

(e) the balancing figure in the scrap account represents the cash received

for the sale of the remaining loss.

Normal loss (scrap) account

Kg $ Kg $

(a) Process account 100 180 (c) Abnormal gain 50 90

(NL)

(e) Cash/Bank 50 90

–––– –––– –––– ––––

100 180 100 180

–––– –––– –––– ––––

Abnormal gain

Kg $ Kg $

(c) Normal loss 50 90 (b) Process 50 1,140

account (AG)

(d) SoPL 1,050

–––– ––––– –––– –––––

50 1,140 50 1,140

–––– ––––– –––– –––––

Note: The abnormal gain reduces the amount of scrap available to be sold so

the value of the scrap debited to the bank account will be $180 – (50 × $1.80)

= $90

The net effect is that the abnormal gain is valued at $1,140 - $90 = $1,050

201