Page 325 - F2 - MA Integrated Workbook STUDENT 2018-19

P. 325

Budgeting

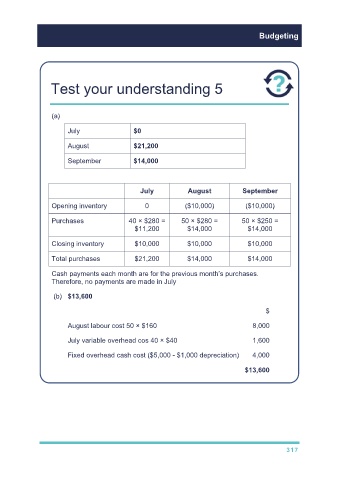

Test your understanding 5

(a)

July $0

August $21,200

September $14,000

July August September

Opening inventory 0 ($10,000) ($10,000)

Purchases 40 × $280 = 50 × $280 = 50 × $250 =

$11,200 $14,000 $14,000

Closing inventory $10,000 $10,000 $10,000

Total purchases $21,200 $14,000 $14,000

Cash payments each month are for the previous month’s purchases.

Therefore, no payments are made in July

(b) $13,600

$

August labour cost 50 × $160 8,000

July variable overhead cos 40 × $40 1,600

Fixed overhead cash cost ($5,000 - $1,000 depreciation) 4,000

$13,600

317