Page 103 - Microsoft Word - 00 ACCA F2 Prelims.docx

P. 103

Accounting for overheads

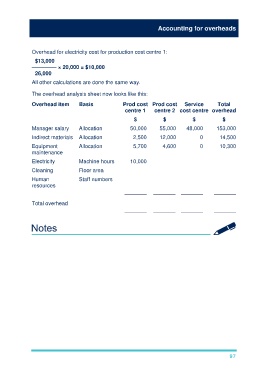

Overhead for electricity cost for production cost centre 1:

$13,000

–———— × 20,000 = $10,000

26,000

All other calculations are done the same way.

The overhead analysis sheet now looks like this:

Overhead item Basis Prod cost Prod cost Service Total

centre 1 centre 2 cost centre overhead

$ $ $ $

Manager salary Allocation 50,000 55,000 48,000 153,000

Indirect materials Allocation 2,500 12,000 0 14,500

Equipment Allocation 5,700 4,600 0 10,300

maintenance

Electricity Machine hours 10,000 3,000 0 13,000

Cleaning Floor area 2,500 2,250 250 5,000

Human Staff numbers 8,000 6,080 1,920 16,000

resources

–––––––– –––––––– –––––––– ––––––––

Total overhead 78,700 82,930 50,170 211,800

–––––––– –––––––– –––––––– ––––––––

97