Page 13 - PowerPoint Presentation

P. 13

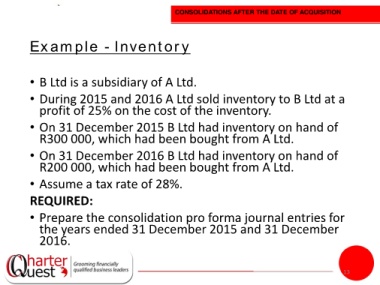

CONSOLIDATIONS AFTER THE DATE OF ACQUISITION

Example - Inventory

• B Ltd is a subsidiary of A Ltd.

• During 2015 and 2016 A Ltd sold inventory to B Ltd at a

profit of 25% on the cost of the inventory.

• On 31 December 2015 B Ltd had inventory on hand of

R300 000, which had been bought from A Ltd.

• On 31 December 2016 B Ltd had inventory on hand of

R200 000, which had been bought from A Ltd.

• Assume a tax rate of 28%.

REQUIRED:

• Prepare the consolidation pro forma journal entries for

the years ended 31 December 2015 and 31 December

2016.

13