Page 18 - PowerPoint Presentation

P. 18

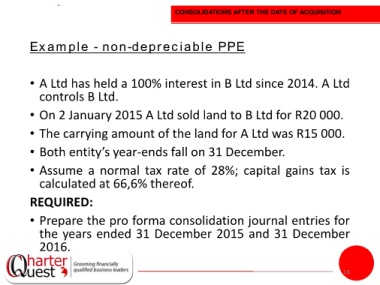

CONSOLIDATIONS AFTER THE DATE OF ACQUISITION

Example - non-depreciable PPE

• A Ltd has held a 100% interest in B Ltd since 2014. A Ltd

controls B Ltd.

• On 2 January 2015 A Ltd sold land to B Ltd for R20 000.

• The carrying amount of the land for A Ltd was R15 000.

• Both entity’s year-ends fall on 31 December.

• Assume a normal tax rate of 28%; capital gains tax is

calculated at 66,6% thereof.

REQUIRED:

• Prepare the pro forma consolidation journal entries for

the years ended 31 December 2015 and 31 December

2016.

18