Page 4 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 4

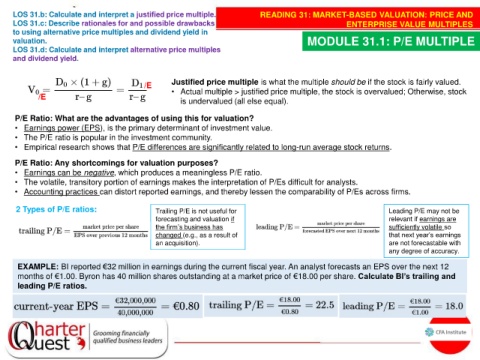

LOS 31.b: Calculate and interpret a justified price multiple. READING 31: MARKET-BASED VALUATION: PRICE AND

LOS 31.c: Describe rationales for and possible drawbacks ENTERPRISE VALUE MULTIPLES

to using alternative price multiples and dividend yield in

valuation. MODULE 31.1: P/E MULTIPLE

LOS 31.d: Calculate and interpret alternative price multiples

and dividend yield.

/E Justified price multiple is what the multiple should be if the stock is fairly valued.

/E • Actual multiple > justified price multiple, the stock is overvalued; Otherwise, stock

is undervalued (all else equal).

P/E Ratio: What are the advantages of using this for valuation?

• Earnings power (EPS), is the primary determinant of investment value.

• The P/E ratio is popular in the investment community.

• Empirical research shows that P/E differences are significantly related to long-run average stock returns.

P/E Ratio: Any shortcomings for valuation purposes?

• Earnings can be negative, which produces a meaningless P/E ratio.

• The volatile, transitory portion of earnings makes the interpretation of P/Es difficult for analysts.

• Accounting practices can distort reported earnings, and thereby lessen the comparability of P/Es across firms.

2 Types of P/E ratios: Trailing P/E is not useful for Leading P/E may not be

forecasting and valuation if relevant if earnings are

the firm’s business has sufficiently volatile so

changed (e.g., as a result of that next year’s earnings

an acquisition). are not forecastable with

any degree of accuracy.

EXAMPLE: BI reported €32 million in earnings during the current fiscal year. An analyst forecasts an EPS over the next 12

months of €1.00. Byron has 40 million shares outstanding at a market price of €18.00 per share. Calculate BI’s trailing and

leading P/E ratios.