Page 8 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 8

LOS 31.b: Calculate and interpret a justified price multiple. READING 31: MARKET-BASED VALUATION: PRICE AND

LOS 31.c: Describe rationales for and possible drawbacks ENTERPRISE VALUE MULTIPLES

to using alternative price multiples and dividend yield in

valuation. MODULE 31.3: P/S AND P/CF MULTIPLE

LOS 31.d: Calculate and interpret alternative price multiples

and dividend yield.

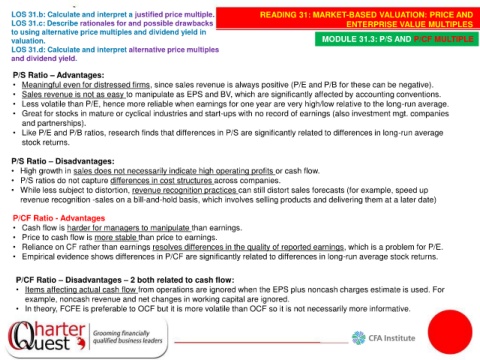

P/S Ratio – Advantages:

• Meaningful even for distressed firms, since sales revenue is always positive (P/E and P/B for these can be negative).

• Sales revenue is not as easy to manipulate as EPS and BV, which are significantly affected by accounting conventions.

• Less volatile than P/E, hence more reliable when earnings for one year are very high/low relative to the long-run average.

• Great for stocks in mature or cyclical industries and start-ups with no record of earnings (also investment mgt. companies

and partnerships).

• Like P/E and P/B ratios, research finds that differences in P/S are significantly related to differences in long-run average

stock returns.

P/S Ratio – Disadvantages:

• High growth in sales does not necessarily indicate high operating profits or cash flow.

• P/S ratios do not capture differences in cost structures across companies.

• While less subject to distortion, revenue recognition practices can still distort sales forecasts (for example, speed up

revenue recognition -sales on a bill-and-hold basis, which involves selling products and delivering them at a later date)

P/CF Ratio - Advantages

• Cash flow is harder for managers to manipulate than earnings.

• Price to cash flow is more stable than price to earnings.

• Reliance on CF rather than earnings resolves differences in the quality of reported earnings, which is a problem for P/E.

• Empirical evidence shows differences in P/CF are significantly related to differences in long-run average stock returns.

P/CF Ratio – Disadvantages – 2 both related to cash flow:

• Items affecting actual cash flow from operations are ignored when the EPS plus noncash charges estimate is used. For

example, noncash revenue and net changes in working capital are ignored.

• In theory, FCFE is preferable to OCF but it is more volatile than OCF so it is not necessarily more informative.