Page 16 - FINAL CFA SLIDES DECEMBER 2018 DAY 12

P. 16

Session Unit 12:

41. Portfolio Risk and Return: Part 1

We know that!

If A was risky asset and B = risk-free..

Zero

So What?

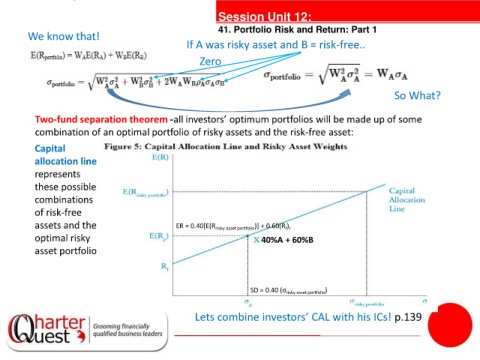

Two-fund separation theorem -all investors’ optimum portfolios will be made up of some

combination of an optimal portfolio of risky assets and the risk-free asset:

Capital

allocation line tanties

represents

these possible

combinations

of risk-free

assets and the ER = 0.40[E(R risky asset portfolio )] + 0.60(R ),

f

optimal risky 40%A + 60%B

asset portfolio

SD = 0.40 (σ risky asset portfolio )

Lets combine investors’ CAL with his ICs! p.139