Page 46 - Chapters 17 & 18 - Dividends & Dividend Tax

P. 46

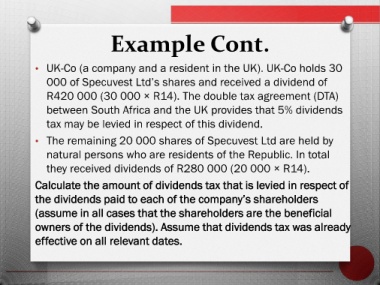

Example Cont.

• UK-Co (a company and a resident in the UK). UK-Co holds 30

000 of Specuvest Ltd’s shares and received a dividend of

R420 000 (30 000 × R14). The double tax agreement (DTA)

between South Africa and the UK provides that 5% dividends

tax may be levied in respect of this dividend.

• The remaining 20 000 shares of Specuvest Ltd are held by

natural persons who are residents of the Republic. In total

they received dividends of R280 000 (20 000 × R14).

Calculate the amount of dividends tax that is levied in respect of

the dividends paid to each of the company’s shareholders

(assume in all cases that the shareholders are the beneficial

owners of the dividends). Assume that dividends tax was already

effective on all relevant dates.