Page 47 - Chapters 17 & 18 - Dividends & Dividend Tax

P. 47

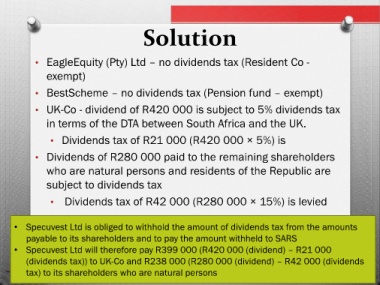

Solution

• EagleEquity (Pty) Ltd – no dividends tax (Resident Co -

exempt)

• BestScheme – no dividends tax (Pension fund – exempt)

• UK-Co - dividend of R420 000 is subject to 5% dividends tax

in terms of the DTA between South Africa and the UK.

• Dividends tax of R21 000 (R420 000 × 5%) is

• Dividends of R280 000 paid to the remaining shareholders

who are natural persons and residents of the Republic are

subject to dividends tax

• Dividends tax of R42 000 (R280 000 × 15%) is levied

• Specuvest Ltd is obliged to withhold the amount of dividends tax from the amounts

payable to its shareholders and to pay the amount withheld to SARS

• Specuvest Ltd will therefore pay R399 000 (R420 000 (dividend) – R21 000

(dividends tax)) to UK-Co and R238 000 (R280 000 (dividend) – R42 000 (dividends

tax) to its shareholders who are natural persons