Page 51 - Chapters 17 & 18 - Dividends & Dividend Tax

P. 51

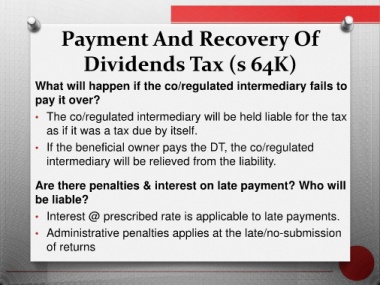

Payment And Recovery Of

Dividends Tax (s 64K)

What will happen if the co/regulated intermediary fails to

pay it over?

• The co/regulated intermediary will be held liable for the tax

as if it was a tax due by itself.

• If the beneficial owner pays the DT, the co/regulated

intermediary will be relieved from the liability.

Are there penalties & interest on late payment? Who will

be liable?

• Interest @ prescribed rate is applicable to late payments.

• Administrative penalties applies at the late/no-submission

of returns