Page 56 - Chapters 17 & 18 - Dividends & Dividend Tax

P. 56

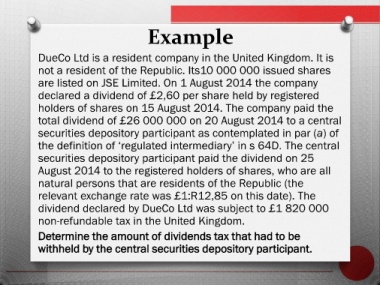

Example

DueCo Ltd is a resident company in the United Kingdom. It is

not a resident of the Republic. Its10 000 000 issued shares

are listed on JSE Limited. On 1 August 2014 the company

declared a dividend of £2,60 per share held by registered

holders of shares on 15 August 2014. The company paid the

total dividend of £26 000 000 on 20 August 2014 to a central

securities depository participant as contemplated in par (a) of

the definition of ‘regulated intermediary’ in s 64D. The central

securities depository participant paid the dividend on 25

August 2014 to the registered holders of shares, who are all

natural persons that are residents of the Republic (the

relevant exchange rate was £1:R12,85 on this date). The

dividend declared by DueCo Ltd was subject to £1 820 000

non-refundable tax in the United Kingdom.

Determine the amount of dividends tax that had to be

withheld by the central securities depository participant.