Page 21 - FINAL CFA SLIDES DECEMBER 2018 DAY 3

P. 21

Session Unit 2:

8. Statistical Concepts and Market Returns

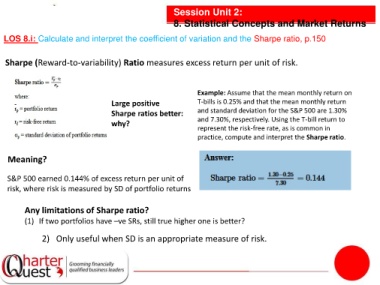

LOS 8.i: Calculate and interpret the coefficient of variation and the Sharpe ratio, p.150

Sharpe (Reward-to-variability) Ratio measures excess return per unit of risk.

Example: Assume that the mean monthly return on

Large positive T-bills is 0.25% and that the mean monthly return

Sharpe ratios better: and standard deviation for the S&P 500 are 1.30%

and 7.30%, respectively. Using the T-bill return to

why?

represent the risk-free rate, as is common in

practice, compute and interpret the Sharpe ratio.

Meaning?

S&P 500 earned 0.144% of excess return per unit of

risk, where risk is measured by SD of portfolio returns

Any limitations of Sharpe ratio?

(1) If two portfolios have –ve SRs, still true higher one is better?

2) Only useful when SD is an appropriate measure of risk.