Page 15 - F6 - Capital Gains Tax - Proceeds, Cost Price & Roll-Overs

P. 15

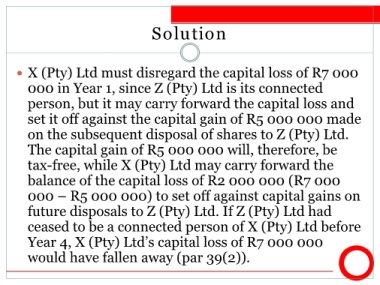

Solution

X (Pty) Ltd must disregard the capital loss of R7 000

000 in Year 1, since Z (Pty) Ltd is its connected

person, but it may carry forward the capital loss and

set it off against the capital gain of R5 000 000 made

on the subsequent disposal of shares to Z (Pty) Ltd.

The capital gain of R5 000 000 will, therefore, be

tax-free, while X (Pty) Ltd may carry forward the

balance of the capital loss of R2 000 000 (R7 000

000 – R5 000 000) to set off against capital gains on

future disposals to Z (Pty) Ltd. If Z (Pty) Ltd had

ceased to be a connected person of X (Pty) Ltd before

Year 4, X (Pty) Ltd’s capital loss of R7 000 000

would have fallen away (par 39(2)).