Page 18 - F6 - Capital Gains Tax - Proceeds, Cost Price & Roll-Overs

P. 18

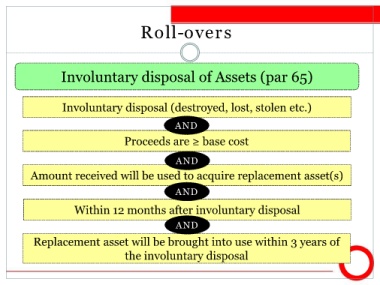

Roll-overs

Involuntary disposal of Assets (par 65)

Involuntary disposal (destroyed, lost, stolen etc.)

AND

Proceeds are ≥ base cost

AND

Amount received will be used to acquire replacement asset(s)

AND

Within 12 months after involuntary disposal

AND

Replacement asset will be brought into use within 3 years of

the involuntary disposal