Page 19 - F6 - Capital Gains Tax - Proceeds, Cost Price & Roll-Overs

P. 19

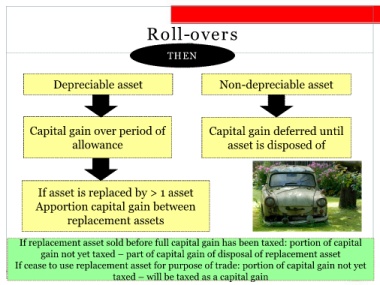

Roll-overs

THEN

Depreciable asset Non-depreciable asset

Capital gain over period of Capital gain deferred until

allowance asset is disposed of

If asset is replaced by > 1 asset

Apportion capital gain between

replacement assets

If replacement asset sold before full capital gain has been taxed: portion of capital

gain not yet taxed – part of capital gain of disposal of replacement asset

If cease to use replacement asset for purpose of trade: portion of capital gain not yet

taxed – will be taxed as a capital gain