Page 11 - PowerPoint Presentation

P. 11

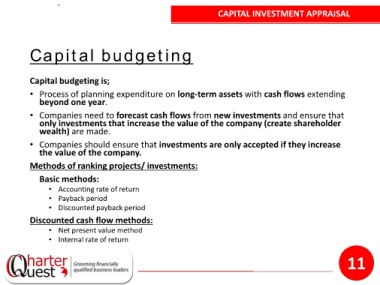

CAPITAL INVESTMENT APPRAISAL

Capital budgeting

Capital budgeting is;

• Process of planning expenditure on long-term assets with cash flows extending

beyond one year.

• Companies need to forecast cash flows from new investments and ensure that

only investments that increase the value of the company (create shareholder

wealth) are made.

• Companies should ensure that investments are only accepted if they increase

the value of the company.

Methods of ranking projects/ investments:

Basic methods:

• Accounting rate of return

• Payback period

• Discounted payback period

Discounted cash flow methods:

• Net present value method

• Internal rate of return

11