Page 17 - F6 - Capital Gains Tax - Debt Reduction

P. 17

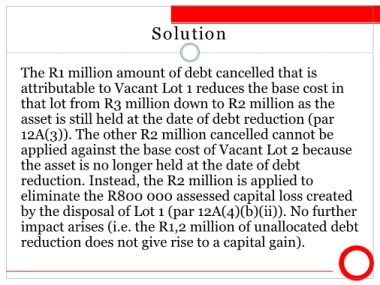

Solution

The R1 million amount of debt cancelled that is

attributable to Vacant Lot 1 reduces the base cost in

that lot from R3 million down to R2 million as the

asset is still held at the date of debt reduction (par

12A(3)). The other R2 million cancelled cannot be

applied against the base cost of Vacant Lot 2 because

the asset is no longer held at the date of debt

reduction. Instead, the R2 million is applied to

eliminate the R800 000 assessed capital loss created

by the disposal of Lot 1 (par 12A(4)(b)(ii)). No further

impact arises (i.e. the R1,2 million of unallocated debt

reduction does not give rise to a capital gain).