Page 16 - F6 - Capital Gains Tax - Debt Reduction

P. 16

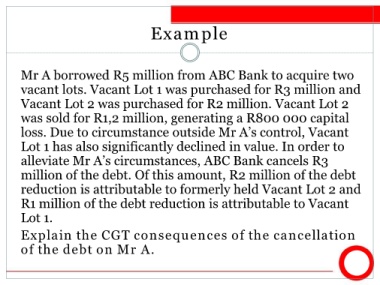

Example

Mr A borrowed R5 million from ABC Bank to acquire two

vacant lots. Vacant Lot 1 was purchased for R3 million and

Vacant Lot 2 was purchased for R2 million. Vacant Lot 2

was sold for R1,2 million, generating a R800 000 capital

loss. Due to circumstance outside Mr A’s control, Vacant

Lot 1 has also significantly declined in value. In order to

alleviate Mr A’s circumstances, ABC Bank cancels R3

million of the debt. Of this amount, R2 million of the debt

reduction is attributable to formerly held Vacant Lot 2 and

R1 million of the debt reduction is attributable to Vacant

Lot 1.

Explain the CGT consequences of the cancellation

of the debt on Mr A.