Page 19 - F6 - Capital Gains Tax - Debt Reduction

P. 19

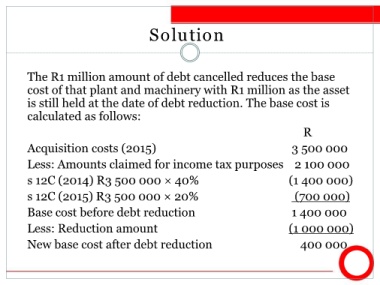

Solution

The R1 million amount of debt cancelled reduces the base

cost of that plant and machinery with R1 million as the asset

is still held at the date of debt reduction. The base cost is

calculated as follows:

R

Acquisition costs (2015) 3 500 000

Less: Amounts claimed for income tax purposes 2 100 000

s 12C (2014) R3 500 000 × 40% (1 400 000)

s 12C (2015) R3 500 000 × 20% (700 000)

Base cost before debt reduction 1 400 000

Less: Reduction amount (1 000 000)

New base cost after debt reduction 400 000