Page 11 - F6 - Capital Gains Tax - Debt Reduction

P. 11

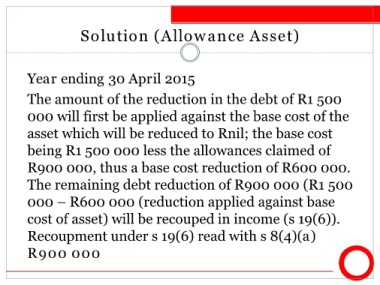

Solution (Allowance Asset)

Year ending 30 April 2015

The amount of the reduction in the debt of R1 500

000 will first be applied against the base cost of the

asset which will be reduced to Rnil; the base cost

being R1 500 000 less the allowances claimed of

R900 000, thus a base cost reduction of R600 000.

The remaining debt reduction of R900 000 (R1 500

000 – R600 000 (reduction applied against base

cost of asset) will be recouped in income (s 19(6)).

Recoupment under s 19(6) read with s 8(4)(a)

R900 000