Page 7 - F6 - Capital Gains Tax - Debt Reduction

P. 7

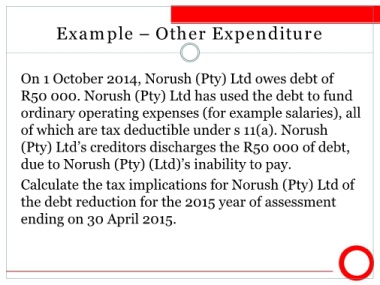

Example – Other Expenditure

On 1 October 2014, Norush (Pty) Ltd owes debt of

R50 000. Norush (Pty) Ltd has used the debt to fund

ordinary operating expenses (for example salaries), all

of which are tax deductible under s 11(a). Norush

(Pty) Ltd’s creditors discharges the R50 000 of debt,

due to Norush (Pty) (Ltd)’s inability to pay.

Calculate the tax implications for Norush (Pty) Ltd of

the debt reduction for the 2015 year of assessment

ending on 30 April 2015.