Page 3 - F6 - Capital Gains Tax - Debt Reduction

P. 3

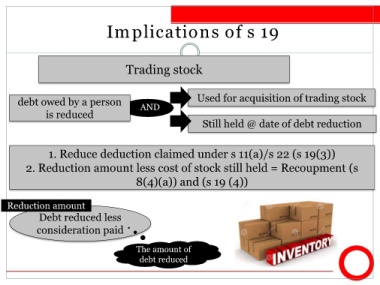

Implications of s 19

Trading stock

debt owed by a person AND Used for acquisition of trading stock

is reduced

Still held @ date of debt reduction

1. Reduce deduction claimed under s 11(a)/s 22 (s 19(3))

2. Reduction amount less cost of stock still held = Recoupment (s

8(4)(a)) and (s 19 (4))

Reduction amount

Debt reduced less

consideration paid

The amount of

debt reduced