Page 4 - F6 - Capital Gains Tax - Debt Reduction

P. 4

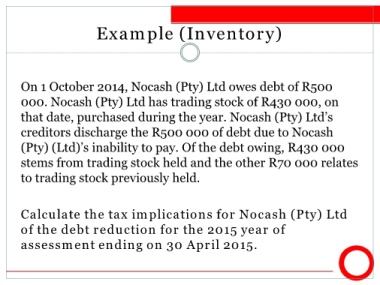

Example (Inventory)

On 1 October 2014, Nocash (Pty) Ltd owes debt of R500

000. Nocash (Pty) Ltd has trading stock of R430 000, on

that date, purchased during the year. Nocash (Pty) Ltd’s

creditors discharge the R500 000 of debt due to Nocash

(Pty) (Ltd)’s inability to pay. Of the debt owing, R430 000

stems from trading stock held and the other R70 000 relates

to trading stock previously held.

Calculate the tax implications for Nocash (Pty) Ltd

of the debt reduction for the 2015 year of

assessment ending on 30 April 2015.