Page 5 - F6 - Capital Gains Tax - Debt Reduction

P. 5

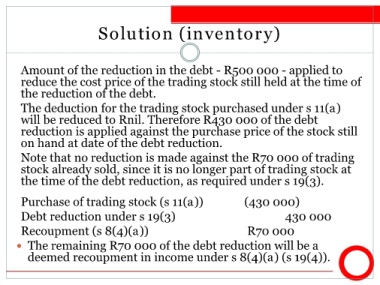

Solution (inventory)

Amount of the reduction in the debt - R500 000 - applied to

reduce the cost price of the trading stock still held at the time of

the reduction of the debt.

The deduction for the trading stock purchased under s 11(a)

will be reduced to Rnil. Therefore R430 000 of the debt

reduction is applied against the purchase price of the stock still

on hand at date of the debt reduction.

Note that no reduction is made against the R70 000 of trading

stock already sold, since it is no longer part of trading stock at

the time of the debt reduction, as required under s 19(3).

Purchase of trading stock (s 11(a)) (430 000)

Debt reduction under s 19(3) 430 000

Recoupment (s 8(4)(a)) R70 000

The remaining R70 000 of the debt reduction will be a

deemed recoupment in income under s 8(4)(a) (s 19(4)).