Page 2 - F6 - Capital Gains Tax - Debt Reduction

P. 2

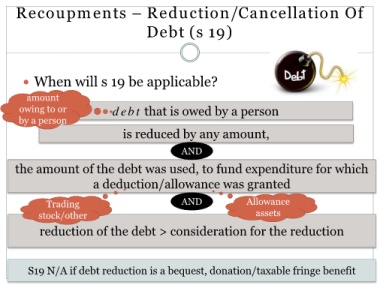

Recoupments – Reduction/Cancellation Of

Debt (s 19)

When will s 19 be applicable?

amount

owing to or debt that is owed by a person

by a person

is reduced by any amount,

AND

the amount of the debt was used, to fund expenditure for which

a deduction/allowance was granted

Trading AND Allowance

stock/other assets

reduction of the debt > consideration for the reduction

S19 N/A if debt reduction is a bequest, donation/taxable fringe benefit