Page 8 - F6 - Capital Gains Tax - Debt Reduction

P. 8

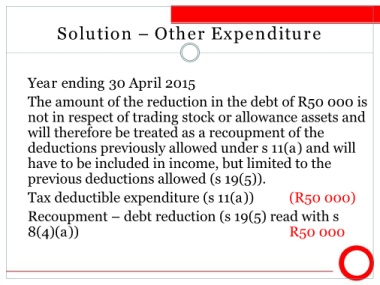

Solution – Other Expenditure

Year ending 30 April 2015

The amount of the reduction in the debt of R50 000 is

not in respect of trading stock or allowance assets and

will therefore be treated as a recoupment of the

deductions previously allowed under s 11(a) and will

have to be included in income, but limited to the

previous deductions allowed (s 19(5)).

Tax deductible expenditure (s 11(a)) (R50 000)

Recoupment – debt reduction (s 19(5) read with s

8(4)(a)) R50 000