Page 10 - Companies & Dividend Tax

P. 10

COMPANIES & CLOSE CORPORATIONS

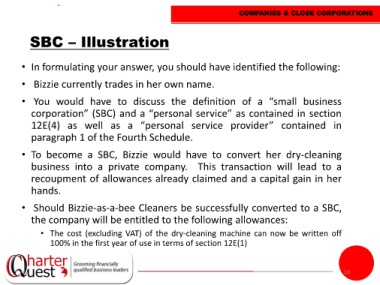

SBC – Illustration

• In formulating your answer, you should have identified the following:

• Bizzie currently trades in her own name.

• You would have to discuss the definition of a “small business

corporation” (SBC) and a “personal service” as contained in section

12E(4) as well as a “personal service provider” contained in

paragraph 1 of the Fourth Schedule.

• To become a SBC, Bizzie would have to convert her dry-cleaning

business into a private company. This transaction will lead to a

recoupment of allowances already claimed and a capital gain in her

hands.

• Should Bizzie-as-a-bee Cleaners be successfully converted to a SBC,

the company will be entitled to the following allowances:

• The cost (excluding VAT) of the dry-cleaning machine can now be written off

100% in the first year of use in terms of section 12E(1)

10