Page 6 - Companies & Dividend Tax

P. 6

COMPANIES & CLOSE CORPORATIONS

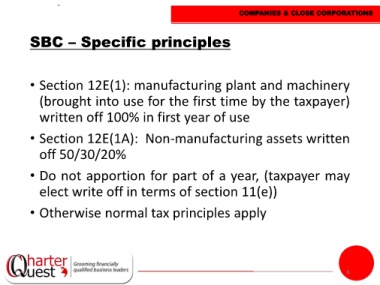

SBC – Specific principles

• Section 12E(1): manufacturing plant and machinery

(brought into use for the first time by the taxpayer)

written off 100% in first year of use

• Section 12E(1A): Non-manufacturing assets written

off 50/30/20%

• Do not apportion for part of a year, (taxpayer may

elect write off in terms of section 11(e))

• Otherwise normal tax principles apply

6