Page 5 - Companies & Dividend Tax

P. 5

COMPANIES & CLOSE CORPORATIONS

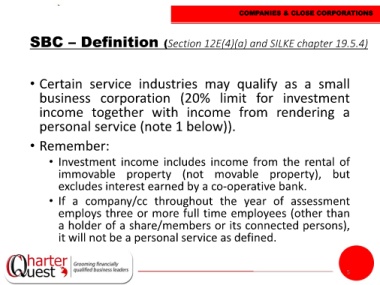

SBC – Definition (Section 12E(4)(a) and SILKE chapter 19.5.4)

• Certain service industries may qualify as a small

business corporation (20% limit for investment

income together with income from rendering a

personal service (note 1 below)).

• Remember:

• Investment income includes income from the rental of

immovable property (not movable property), but

excludes interest earned by a co-operative bank.

• If a company/cc throughout the year of assessment

employs three or more full time employees (other than

a holder of a share/members or its connected persons),

it will not be a personal service as defined.

5