Page 42 - Companies & Dividend Tax

P. 42

DIVIDENDS

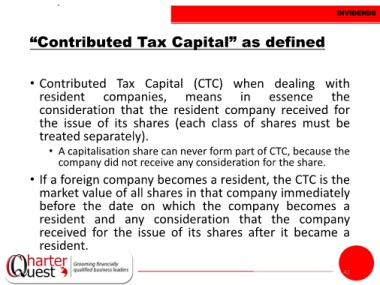

“Contributed Tax Capital” as defined

• Contributed Tax Capital (CTC) when dealing with

resident companies, means in essence the

consideration that the resident company received for

the issue of its shares (each class of shares must be

treated separately).

• A capitalisation share can never form part of CTC, because the

company did not receive any consideration for the share.

• If a foreign company becomes a resident, the CTC is the

market value of all shares in that company immediately

before the date on which the company becomes a

resident and any consideration that the company

received for the issue of its shares after it became a

resident.

42