Page 43 - Companies & Dividend Tax

P. 43

DIVIDENDS

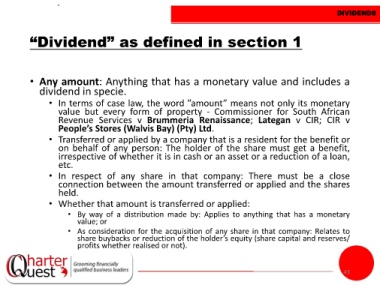

“Dividend” as defined in section 1

• Any amount: Anything that has a monetary value and includes a

dividend in specie.

• In terms of case law, the word ”amount” means not only its monetary

value but every form of property - Commissioner for South African

Revenue Services v Brummeria Renaissance; Lategan v CIR; CIR v

People’s Stores (Walvis Bay) (Pty) Ltd.

• Transferred or applied by a company that is a resident for the benefit or

on behalf of any person: The holder of the share must get a benefit,

irrespective of whether it is in cash or an asset or a reduction of a loan,

etc.

• In respect of any share in that company: There must be a close

connection between the amount transferred or applied and the shares

held.

• Whether that amount is transferred or applied:

• By way of a distribution made by: Applies to anything that has a monetary

value; or

• As consideration for the acquisition of any share in that company: Relates to

share buybacks or reduction of the holder’s equity (share capital and reserves/

profits whether realised or not).

43