Page 44 - Companies & Dividend Tax

P. 44

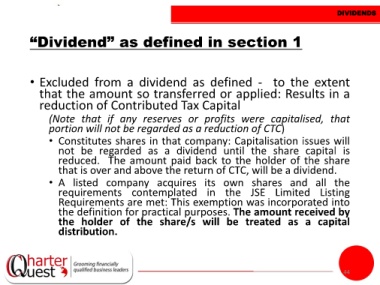

DIVIDENDS

“Dividend” as defined in section 1

• Excluded from a dividend as defined - to the extent

that the amount so transferred or applied: Results in a

reduction of Contributed Tax Capital

(Note that if any reserves or profits were capitalised, that

portion will not be regarded as a reduction of CTC)

• Constitutes shares in that company: Capitalisation issues will

not be regarded as a dividend until the share capital is

reduced. The amount paid back to the holder of the share

that is over and above the return of CTC, will be a dividend.

• A listed company acquires its own shares and all the

requirements contemplated in the JSE Limited Listing

Requirements are met: This exemption was incorporated into

the definition for practical purposes. The amount received by

the holder of the share/s will be treated as a capital

distribution.

44