Page 15 - FINAL CFA SLIDES DECEMBER 2018 DAY 13

P. 15

Session Unit 13:

44. Market Structure & organisation

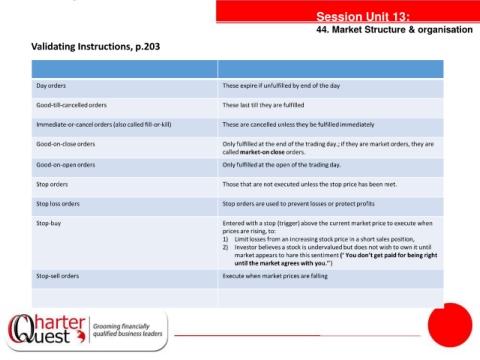

Validating Instructions, p.203

Day orders These expire if unfulfilled by end of the day

Good-till-cancelled orders These last till they are fulfilled

Immediate-or-cancel orders (also called fill-or-kill) These are cancelled unless they be fulfilled immediately

Good-on-close orders Only fulfilled at the end of the trading day.; if they are market orders, they are

tanties

called market-on close orders.

Good-on-openorders Only fulfilled at the open of the trading day.

Stop orders Those that are not executed unless the stop price has been met.

Stop loss orders Stop orders are used to prevent losses or protect profits

Stop-buy Entered with a stop (trigger) above the current market price to execute when

prices are rising, to:

1) Limit losses from an increasing stock price in a short sales position,

2) Investor believes a stock is undervalued but does not wish to own it until

market appears to hare this sentiment (‘ You don’t get paid for being right

until the market agrees with you.’’)

Stop-sell orders Execute when market prices are falling