Page 18 - FINAL CFA SLIDES DECEMBER 2018 DAY 13

P. 18

Session Unit 13:

44. Market Structure & organisation

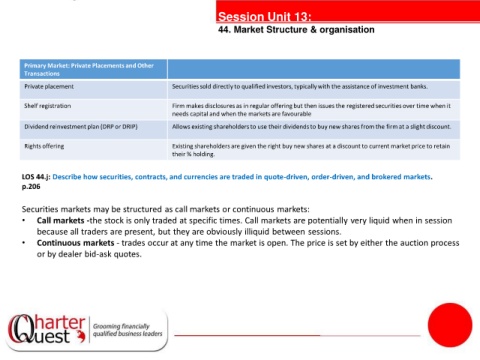

Primary Market: Private Placements and Other

Transactions

Private placement Securities sold directly to qualified investors, typically with the assistance of investment banks.

Shelf registration Firm makes disclosures as in regular offering but then issues the registered securities over time when it

needs capital and when the markets are favourable

Dividend reinvestment plan (DRP or DRIP) Allows existing shareholders to use their dividends to buy new shares from the firm at a slight discount.

tanties

Rights offering Existing shareholders are given the right buy new shares at a discount to current market price to retain

their % holding.

LOS 44.j: Describe how securities, contracts, and currencies are traded in quote-driven, order-driven, and brokered markets.

p.206

Securities markets may be structured as call markets or continuous markets:

• Call markets -the stock is only traded at specific times. Call markets are potentially very liquid when in session

because all traders are present, but they are obviously illiquid between sessions.

• Continuous markets - trades occur at any time the market is open. The price is set by either the auction process

or by dealer bid-ask quotes.