Page 15 - F6 - Capital Gains Tax - Assets & Disposals

P. 15

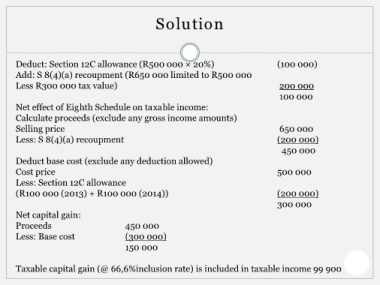

Solution

Deduct: Section 12C allowance (R500 000 × 20%) (100 000)

Add: S 8(4)(a) recoupment (R650 000 limited to R500 000

Less R300 000 tax value) 200 000

100 000

Net effect of Eighth Schedule on taxable income:

Calculate proceeds (exclude any gross income amounts)

Selling price 650 000

Less: S 8(4)(a) recoupment (200 000)

450 000

Deduct base cost (exclude any deduction allowed)

Cost price 500 000

Less: Section 12C allowance

(R100 000 (2013) + R100 000 (2014)) (200 000)

300 000

Net capital gain:

Proceeds 450 000

Less: Base cost (300 000)

150 000

Taxable capital gain (@ 66,6%inclusion rate) is included in taxable income 99 900