Page 16 - F6 - Capital Gains Tax - Assets & Disposals

P. 16

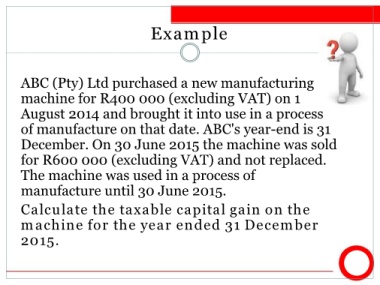

Example

ABC (Pty) Ltd purchased a new manufacturing

machine for R400 000 (excluding VAT) on 1

August 2014 and brought it into use in a process

of manufacture on that date. ABC's year-end is 31

December. On 30 June 2015 the machine was sold

for R600 000 (excluding VAT) and not replaced.

The machine was used in a process of

manufacture until 30 June 2015.

Calculate the taxable capital gain on the

machine for the year ended 31 December

2015.