Page 3 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 3

LOS 20.a: Calculate the yearly cash flows of expansion and READING 20: CAPITAL BUDGETING

replacement capital projects and evaluate how the choice of

depreciation method affects those cash flows.

MODULE 20.1: CASH FLOW ESTIMATION

Categories of Capital Budgeting Projects

• Replacement projects to maintain the business.

• Replacement projects for cost reduction. Principles of Capital Budgeting

• Expansion projects. 1. Decisions are based on cash flows, not accounting income (incremental cash flows).

• New product or market development. 2. Cash flows are based on opportunity costs.

• Mandatory projects may be required by a 3. The timing of cash flows is important. Capital budgeting decisions account for the time value of money,

which means that cash flows received earlier are worth more than cash flows to be received later.

governmental agency or insurance company. 4. Cash flows are analyzed on an after-tax basis.

• Other projects. 5. Financing costs are reflected in the project’s required rate of return.

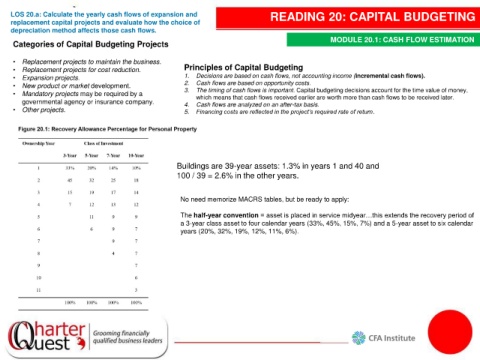

Buildings are 39-year assets: 1.3% in years 1 and 40 and

100 / 39 = 2.6% in the other years.

No need memorize MACRS tables, but be ready to apply:

The half-year convention = asset is placed in service midyear…this extends the recovery period of

a 3-year class asset to four calendar years (33%, 45%, 15%, 7%) and a 5-year asset to six calendar

years (20%, 32%, 19%, 12%, 11%, 6%).