Page 6 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 6

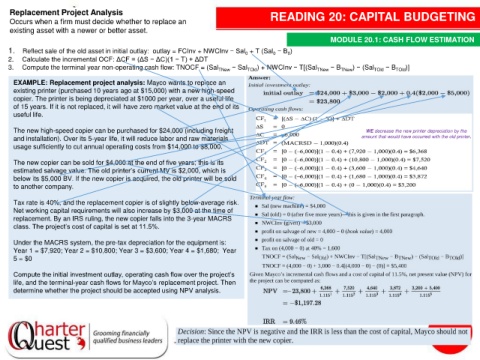

Replacement Project Analysis READING 20: CAPITAL BUDGETING

Occurs when a firm must decide whether to replace an

existing asset with a newer or better asset.

MODULE 20.1: CASH FLOW ESTIMATION

1. Reflect sale of the old asset in initial outlay: outlay = FCInv + NWCInv − Sal + T (Sal − B )

0

0

0

2. Calculate the incremental OCF: ΔCF = (ΔS − ΔC)(1 − T) + ΔDT

3. Compute the terminal year non-operating cash flow: TNOCF = (Sal TNew − Sal TOld ) + NWCInv − T[(Sal TNew − B TNew ) − (Sal TOld − B TOld )]

EXAMPLE: Replacement project analysis: Mayco wants to replace an

existing printer (purchased 10 years ago at $15,000) with a new high-speed

copier. The printer is being depreciated at $1000 per year, over a useful life

of 15 years. If it is not replaced, it will have zero market value at the end of its

useful life.

The new high-speed copier can be purchased for $24,000 (including freight WE decrease the new printer depreciation by the

and installation). Over its 5-year life, it will reduce labor and raw materials amount that would have occurred with the old printer.

usage sufficiently to cut annual operating costs from $14,000 to $8,000.

The new copier can be sold for $4,000 at the end of five years; this is its

estimated salvage value. The old printer’s current MV is $2,000, which is

below its $5,000 BV. If the new copier is acquired, the old printer will be sold

to another company.

Tax rate is 40%, and the replacement copier is of slightly below-average risk.

Net working capital requirements will also increase by $3,000 at the time of

replacement. By an IRS ruling, the new copier falls into the 3-year MACRS

class. The project’s cost of capital is set at 11.5%.

Under the MACRS system, the pre-tax depreciation for the equipment is:

Year 1 = $7,920; Year 2 = $10,800; Year 3 = $3,600; Year 4 = $1,680; Year

5 = $0

Compute the initial investment outlay, operating cash flow over the project’s

life, and the terminal-year cash flows for Mayco’s replacement project. Then

determine whether the project should be accepted using NPV analysis.