Page 9 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 9

LOS 20.d: Explain how sensitivity analysis, scenario analysis,

and Monte Carlo simulation can be used to assess the stand- READING 20: CAPITAL BUDGETING

alone risk of a capital project.

Sensitivity analysis involves changing an input (independent) variable to MODULE 20.2: EVALUATION OF PROJECTS AND DISCOUNT RATE ESTIMATION

see how sensitive the dependent variable is to the input variable.

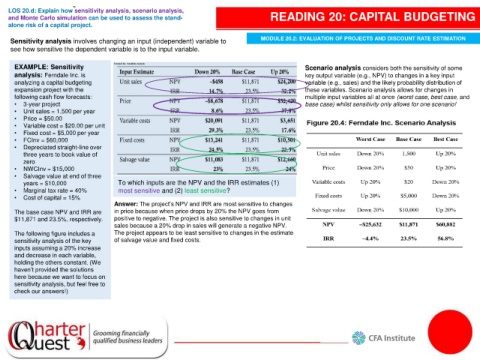

EXAMPLE: Sensitivity Scenario analysis considers both the sensitivity of some

analysis: Ferndale Inc. is key output variable (e.g., NPV) to changes in a key input

analyzing a capital budgeting variable (e.g., sales) and the likely probability distribution of

expansion project with the these variables. Scenario analysis allows for changes in

following cash flow forecasts: multiple input variables all at once (worst case, best case, and

• 3-year project base case) whilst sensitivity only allows for one scenario!

• Unit sales = 1,500 per year

• Price = $50.00

• Variable cost = $20.00 per unit

• Fixed cost = $5,000 per year

• FCInv = $60,000

• Depreciated straight-line over

three years to book value of

zero

• NWCInv = $15,000

• Salvage value at end of three

years = $10,000 To which inputs are the NPV and the IRR estimates (1)

• Marginal tax rate = 40% most sensitive and (2) least sensitive?

• Cost of capital = 15%

Answer: The project’s NPV and IRR are most sensitive to changes

The base case NPV and IRR are in price because when price drops by 20% the NPV goes from

$11,871 and 23.5%, respectively. positive to negative. The project is also sensitive to changes in unit

sales because a 20% drop in sales will generate a negative NPV.

The following figure includes a The project appears to be least sensitive to changes in the estimate

sensitivity analysis of the key of salvage value and fixed costs.

inputs assuming a 20% increase

and decrease in each variable,

holding the others constant. (We

haven’t provided the solutions

here because we want to focus on

sensitivity analysis, but feel free to

check our answers!)