Page 13 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 13

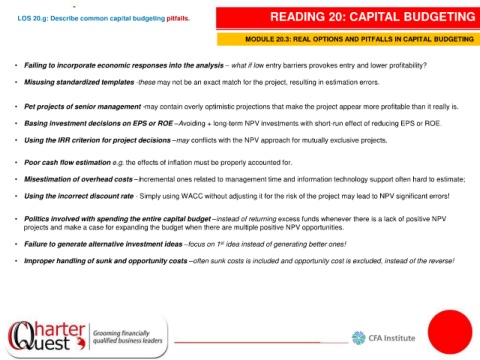

LOS 20.g: Describe common capital budgeting pitfalls. READING 20: CAPITAL BUDGETING

MODULE 20.3: REAL OPTIONS AND PITFALLS IN CAPITAL BUDGETING

• Failing to incorporate economic responses into the analysis – what if low entry barriers provokes entry and lower profitability?

• Misusing standardized templates -these may not be an exact match for the project, resulting in estimation errors.

• Pet projects of senior management -may contain overly optimistic projections that make the project appear more profitable than it really is.

• Basing investment decisions on EPS or ROE –Avoiding + long-term NPV investments with short-run effect of reducing EPS or ROE.

• Using the IRR criterion for project decisions –may conflicts with the NPV approach for mutually exclusive projects.

• Poor cash flow estimation e.g. the effects of inflation must be properly accounted for.

• Misestimation of overhead costs –Incremental ones related to management time and information technology support often hard to estimate;

• Using the incorrect discount rate - Simply using WACC without adjusting it for the risk of the project may lead to NPV significant errors!

• Politics involved with spending the entire capital budget –instead of returning excess funds whenever there is a lack of positive NPV

projects and make a case for expanding the budget when there are multiple positive NPV opportunities.

• Failure to generate alternative investment ideas –focus on 1 idea instead of generating better ones!

st

• Improper handling of sunk and opportunity costs –often sunk costs is included and opportunity cost is excluded, instead of the reverse!